Business parks experience a comeback

Business parks experience a comeback

The flexibility of business parks is currently hitting a nerve, with more and more companies from the classic B-to-C sector renting space there. Investors have also long since discovered them for themselves, and construction activity has more than doubled within four years. For the first time, the "Spotlight Business Parks" study by the Initiative Unternehmensimmobilien is also illustrating the background to this trend to a wider audience.

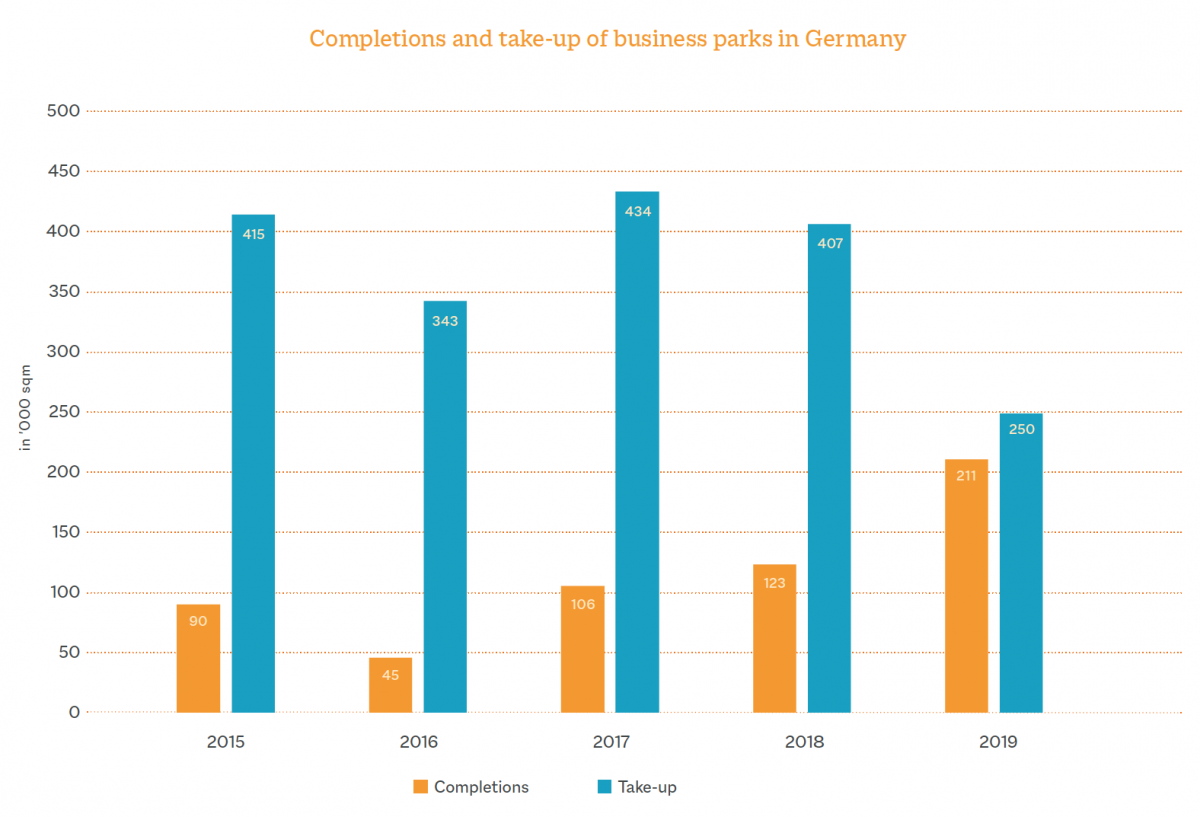

As past market reports of the Initiative Unternehmensimmobilien show, business parks are the most demanded among corporate real estate, accounting for almost 40% of the total investment volume in 2019 with a transaction volume of almost 1.2 billion euros. Construction activity has also developed just as steeply: in 2015, around 90,000 square meters of space were completed, four years later the figure was already 210,000 square meters - and the project developers' pipelines are full.

Six members, all of whom are experienced practitioners in this field, have joined forces for the "Spotlight Business Parks" study of the Initiative Unternehmensimmobilien. For many users, business parks combine the essential links in the value chain at just one location. From the operator's point of view, the flexibility and heterogeneity result in higher management costs compared to single use properties, but the risk of vacancies is also lower and the length of stay of tenants is high.

Business parks have been developed in Germany since the mid-1970s. As a separate asset class, however, they were not in demand among investors for a long time, and the market was not transparent. With the beginning of the 2010s, the importance of business parks increased significantly.

Currently, business parks are in such high demand again because their flexibility taps a nerve. More and more companies from the classic B-to-C sector are renting there. The rapidly growing share of e-commerce is forcing these companies to move closer to their customers in order to be able to compete with the ever shorter delivery times of the industry giants. A second important factor is the changing production conditions. The standards of Industry 4.0 are accompanied by a very close integration of production, logistics, office and service. In contrast to many other objects, business parks can meet these requirements. We assume that the demand for industrial parks will remain high in the long term.

The rediscovery of business parks in the environment of start-ups, digitalization and economic growth has made itself felt in recent years both on the demand side and in an expansion of supply. In the majority of the last five years, the annual space turnover in business parks has been above the 400,000 sqm mark and averaged around 370,000 sqm annually over the entire period. In the more recent history of business parks, 2019 marked a record level with a new construction volume of around 210,000 sqm of usable space. Compared to 2016, the volume of completions has almost quintupled.

Business parks offer a broad spectrum of users. The flexible combination of logistics and office space and their location close to the city center appeal strongly to users from the logistics and transport sectors or manufacturing companies, primarily light industry. These core groups alone accounted for just under 44% of the take-ups in the period under review.

* The four defined categories of corporate real estate in the market reports published since 2013 are converted properties, business parks, warehouse properties and light manufacturing properties.

Note: You will be able to download the market report from the bulwiengesa-website

Contact persons: Patrik Völtz, voeltz [at] bulwiengesa.de and Daniel Sopka, sopka [at] bulwiengesa.de