German corporate real estate takes on exotic status

German corporate real estate takes on exotic status

On the Anglo-Saxon real estate markets, light industrial properties are nothing exotic but have been established as popular investment objectives for a long time. Unternehmensimmobilien, their German equivalent, have now caught up to them.

This is suggested not least by the massive portfolio acquisitions by foreign investors as well as by the steadily hardening cap rates, meaning the ratio of net earnings to purchase price. However, the high owner-occupancy rate in Germany can also hamper investments.

The German term “Unternehmensimmobilien” includes, unlike the term “light industrial property,” converted properties, which require a comprehensive revitalisation and structural alteration before being put to new commercial use. They tend to come with a historic industrial charm.

Steep Drop in Cap Rates

Looking at the average cap rate for industrial real estate (including large-scale logistics assets) is a good way to put the German market for Unternehmensimmobilien into the international context.

The average cap rate in Germany’s industrial real estate segment was much more volatile between 2012 and 2015 when compared to the markets in the United States and the United Kingdom. But in 2015, investment demand in Germany began to surge at such a brisk pace that the average cap rate declined more or less steadily, dropping from 8.0 % (2015) to 6.3 % by the end of 2017, in some places actually undercutting comparables in the US and UK markets.

Despite the volatility, the German market has shown a dynamic performance in recent years. And a look at the overall investment potential makes it safe to say there is plenty of growth potential left.

The share that industrial real estate claimed in the commercial transaction total in Germany was admittedly much lower than on the reference markets during the period under review (2012 and subsequent years). However, the asset class has noticeably gained in significance in Germany: At 12 %, it crossed into the two-digit range in 2017 for the first time, which is twice of what it was in 2015—a fact explained, in addition to investments in Unternehmensimmobilien, by the strong demand for large-scale logistics real estate.

Portfolio Acquisitions Favour Metro Areas

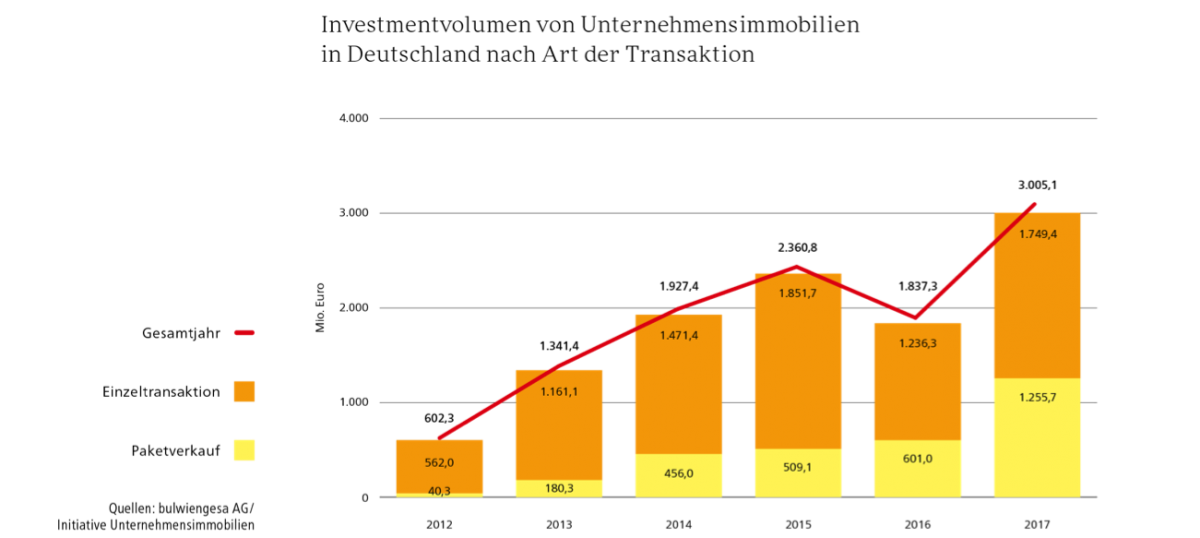

The keen interest among international players is also highlighted by the way transaction volumes of portfolio acquisitions have been trending. Investments in larger portfolios or the acquisition of entire companies permit the instant placement of large sums of capital in a given market.

During the banner year of 2017, both the transaction total and the market share of package sales climbed to a new high-water mark of roughly 42 %. Over 1.2 billion euros were invested in portfolio acquisitions, which is more than the year-end totals of 2015 and 2016 combined. International investors accounted for the bulk of it. Their market entry has caused the sum total committed in Unternehmensimmobilien portfolios to multiply. Accordingly, the record-breaking transaction volumes recently seen in the asset class of Unternehmensimmobilien is closely linked to the intense market presence of international investors.

There is a manifest difference between domestic and cross-border investors as far as regional preferences go: International investors have so far bought mainly in or near German metro regions. Given the positive demographic and economic developments, these are exposed to a relatively low investment risk.

Conversely, domestic investors with a detailed knowledge of the market will often invest in Unternehmensimmobilien outside the conurbations because they have an easier time appraising a given property beyond its macroeconomic performance indicators.

Alistair Marks, Chief Financial Officer of Sirius Facilities GmbH, suggests as much when elaborating his company’s approach: “Going forward, we will keep our investment focus on secondary and tertiary locations in the metro regions of the ‘Big 7’ cities. After all, demand and pricing for our range of products is much higher in these locations. Moreover, we believe that tertiary locations around Class A cities offer better opportunities than secondary locations in the vicinity of B or C class cities.”

High Owner-Occupancy Rate Stalling Investments

Now, as then, Unternehmensimmobilien assets are owner-occupied more often than is the case in the United States or the United Kingdom. To ensure that the German market for Unternehmensimmobilien remains a sustainably attractive investment destination, more of the owner-occupied stock should be diverted to the investment market. It is the only way to prevent a slowdown in investment activity due to short supply. This is particularly true for the floor space stock of major industrial companies that are often no longer required for owner-occupancy in their entirety.

Martin Czaja, CEO of BEOS AG, commented on the link between property ownership rates and transparency: “In the same sense that international investors have made swifter progress in terms of transparency, they are also more experienced in our asset class. A look at the ownership rates alone suggests as much: While 70 % of the companies in Germany own their real estate outright, the ratio is no higher than 40 % in the United Kingdom, only 30 % in the United States, and just 20 % in Asia. Indeed, the German Unternehmensimmobilien market would not have taken off the way it did without international investors.”

Would you like to learn more about the subjects discussed above? If so, we recommend checking out the second issue of the magazine “UI Insight #2” with its focus topic of “German Unternehmensimmobilien in the Global Context.” In this issue:

- Alistair Marks, Chief Financial Officer of Sirius, discusses the potential of the asset class Unternehmensimmobilien for domestic and foreign investors.

- Analytics: Putting German Unternehmensimmobilien in Global Context

- In the interview, Martin Czaja, CEO of BEOS AG, talks about doing business with international investors.

For more details about Initiative Unternehmensimmobilien, go to http://unternehmensimmobilien.net/

Contact person: Patrik Völtz, Industrial and Logistics Real Estate at bulwiengesa, voeltz [at] bulwiengesa.de